Every day we analyse the market trends, select the most newsworthy asset, and prepare technical analysis on it—to help you reduce risks and get prepared.

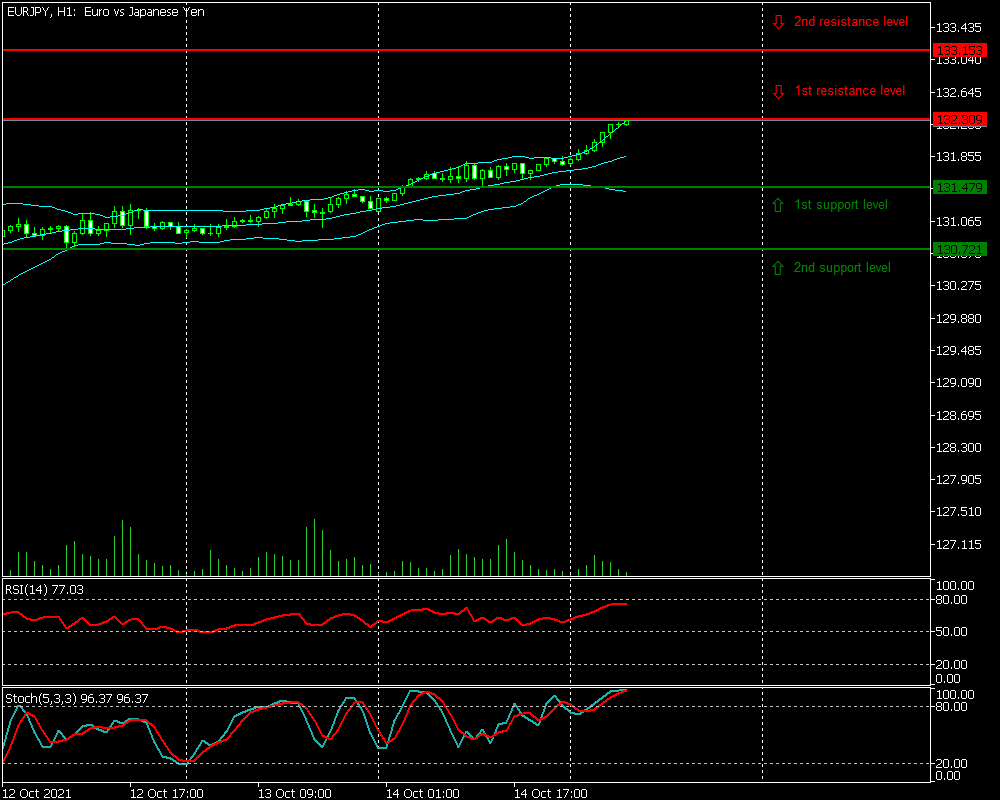

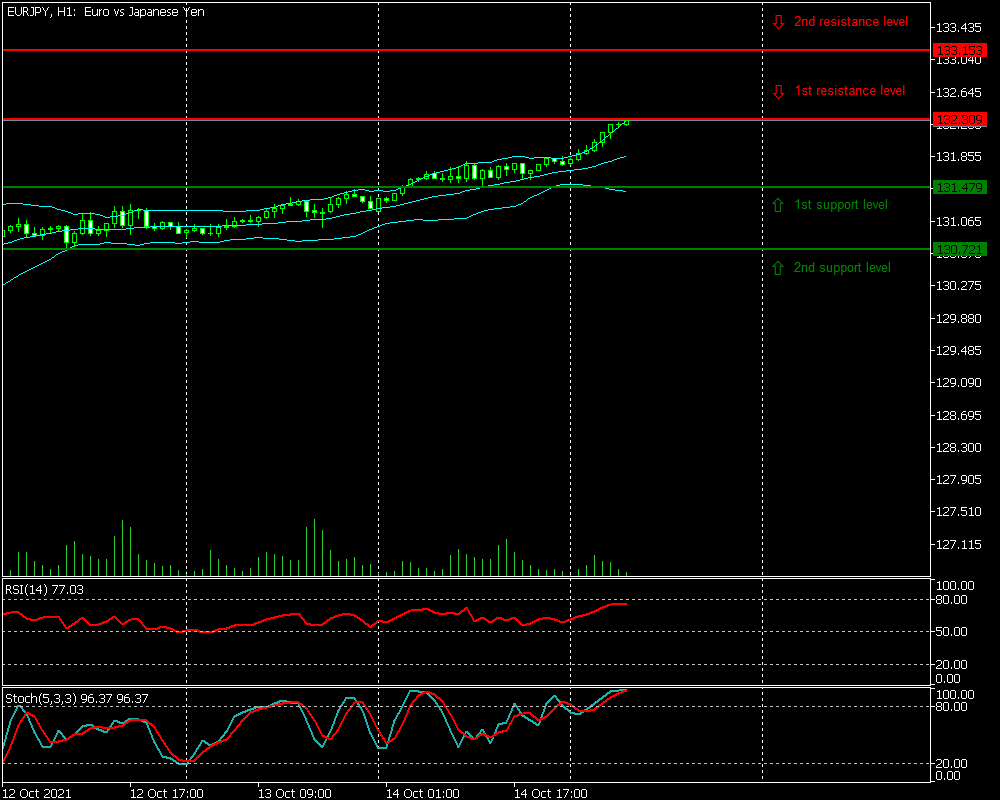

EURJPY rose to a three-month high at 132.309 because the yen declined against major peers on Thursday. Today, Japanese Finance Minister Shunichi Suzuki said the government would scrutinise the fallout from recent yen declines, which he described as having pros and cons for the economy. In September, Japan’s wholesale inflation hit a 13-year high as rising global commodity prices and a weak yen pushed up import costs, putting pressure on corporate margins and raising the risk of unwanted consumer price hikes.

The Bollinger Bands predict increased volatility as they begin to diverge, giving off a likely bullish signal. The RSI is above 50, pointing to a potential uptrend, while the Stochastic is the overbought zone, indicating a possible downwards correction.

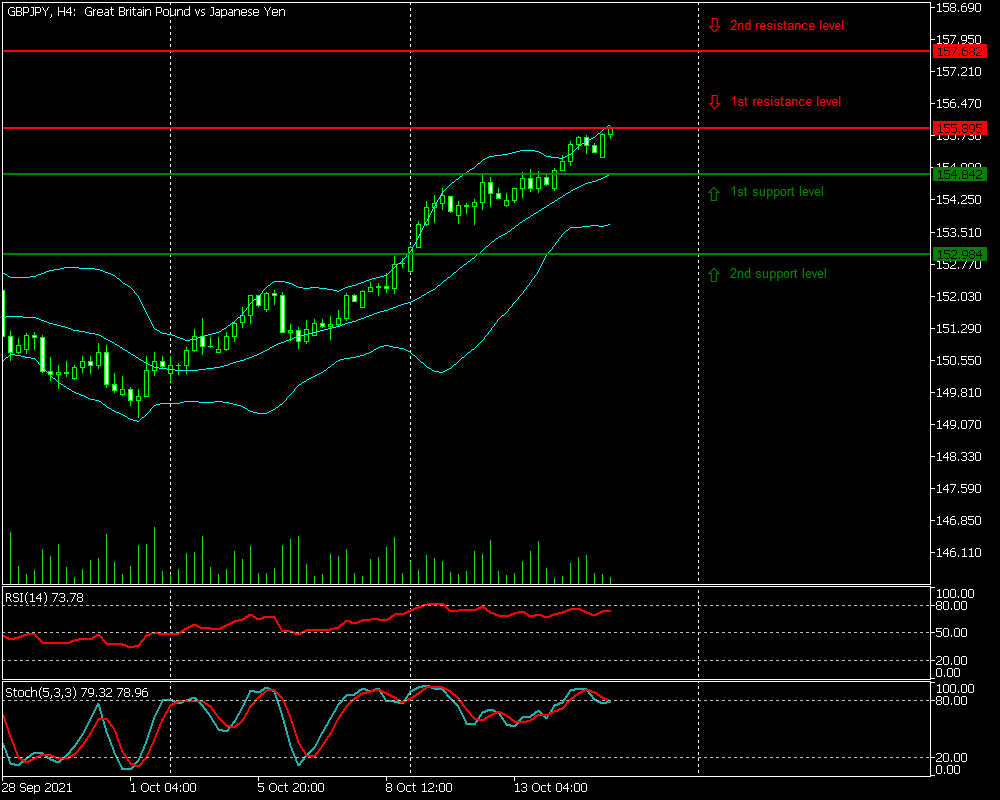

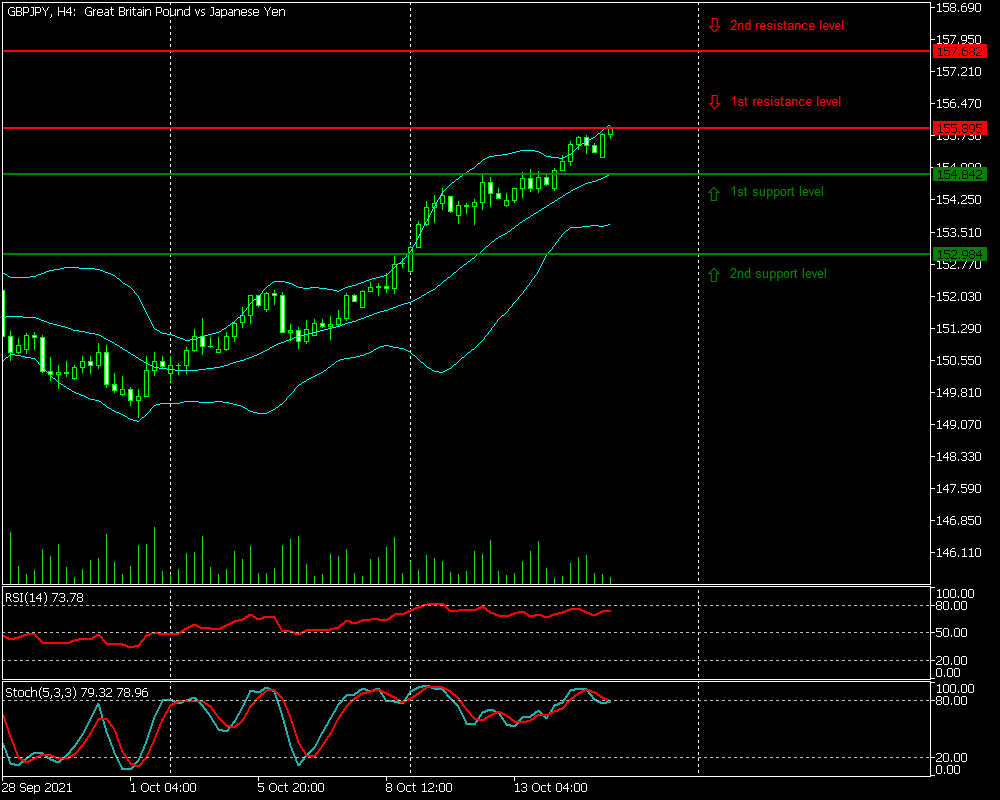

GBPJPY reached a six-month high at 155.895 as traders hope to avoid a post-Brexit trade war with the European Union and expect the Bank of England to raise rates this year. The pound was also helped by the yen's weakness as upbeat sentiment lifted stock markets and risk-oriented currencies such as sterling.

The Bollinger Bands are predicting increased volatility as they begin to diverge, giving off a bullish signal. The RSI is above 50, suggesting an uptrend, while the Stochastic indicates a possible downwards correction.

BTCUSD reached 59,125.87 USD. The first cryptocurrency has updated its price maximum since 10 May. Meanwhile, increased demand from institutional investors caused an early rise in bitcoin value. Analysts say that in recent weeks the market has been 'actively shifting towards buyers'. Moreover, increasing the U.S. national debt and fears of a potential default might significantly boost the bitcoin price.

The Bollinger Bands are spreading, which means increased volatility. The RSI, which is above 50, and the Stochastic both point to a potential uptrend.

EURJPY rose to a three-month high at 132.309 because the yen declined against major peers on Thursday. Today, Japanese Finance Minister Shunichi Suzuki said the government would scrutinise the fallout from recent yen declines, which he described as having pros and cons for the economy. In September, Japan’s wholesale inflation hit a 13-year high as rising global commodity prices and a weak yen pushed up import costs, putting pressure on corporate margins and raising the risk of unwanted consumer price hikes.

The Bollinger Bands predict increased volatility as they begin to diverge, giving off a likely bullish signal. The RSI is above 50, pointing to a potential uptrend, while the Stochastic is the overbought zone, indicating a possible downwards correction.

GBPJPY reached a six-month high at 155.895 as traders hope to avoid a post-Brexit trade war with the European Union and expect the Bank of England to raise rates this year. The pound was also helped by the yen's weakness as upbeat sentiment lifted stock markets and risk-oriented currencies such as sterling.

The Bollinger Bands are predicting increased volatility as they begin to diverge, giving off a bullish signal. The RSI is above 50, suggesting an uptrend, while the Stochastic indicates a possible downwards correction.

BTCUSD reached 59,125.87 USD. The first cryptocurrency has updated its price maximum since 10 May. Meanwhile, increased demand from institutional investors caused an early rise in bitcoin value. Analysts say that in recent weeks the market has been 'actively shifting towards buyers'. Moreover, increasing the U.S. national debt and fears of a potential default might significantly boost the bitcoin price.

The Bollinger Bands are spreading, which means increased volatility. The RSI, which is above 50, and the Stochastic both point to a potential uptrend.

I'm a cool paragraph that lives inside of an even cooler modal. Wins!